Stock Performance Analysis

Crowdstrike stock – CrowdStrike Holdings, Inc. (CRWD) is an American cybersecurity technology company based in Sunnyvale, California. It provides cloud-based endpoint protection, threat intelligence, and managed security services to businesses. CrowdStrike’s stock has performed well in recent years, with a strong track record of growth and profitability.

There are several factors that have contributed to CrowdStrike’s stock price fluctuations. These include:

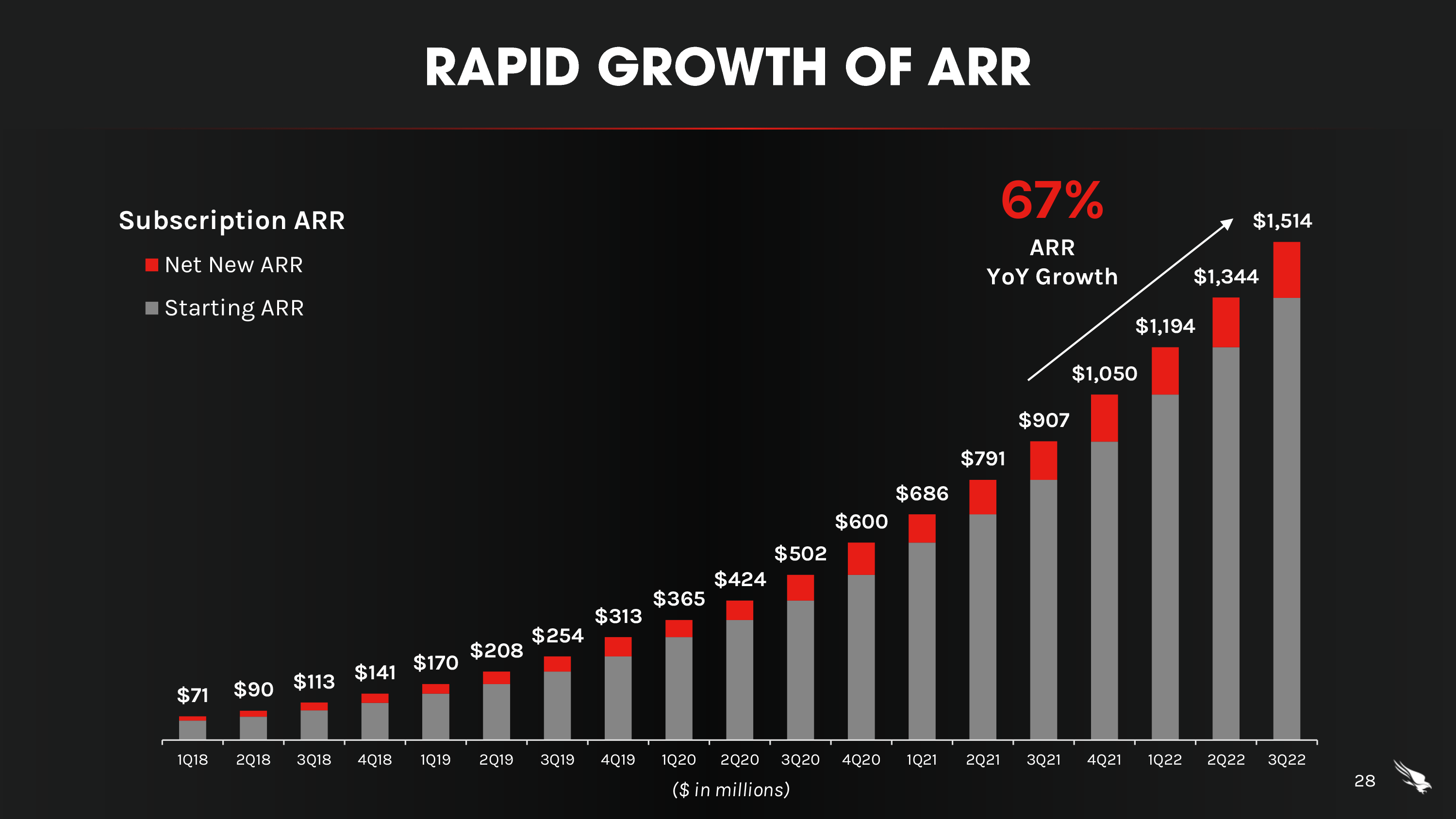

- Strong financial performance: CrowdStrike has consistently reported strong financial results, with revenue and earnings growing at a rapid pace. This has led to increased investor confidence and demand for the stock.

- Growing demand for cybersecurity solutions: The demand for cybersecurity solutions has increased significantly in recent years due to the rising number of cyberattacks. CrowdStrike is well-positioned to benefit from this trend, as it offers a comprehensive suite of cybersecurity solutions that are in high demand.

- Positive analyst coverage: CrowdStrike has received positive analyst coverage from a number of Wall Street firms. This has helped to raise the profile of the company and attract new investors.

- Expansion into new markets: CrowdStrike has been expanding into new markets, such as Europe and Asia. This has helped to drive growth and diversify the company’s revenue stream.

CrowdStrike’s stock price has also been affected by broader market trends. For example, the stock has declined in value during periods of market volatility. However, the stock has generally outperformed the broader market over the long term.

Overall, CrowdStrike’s stock performance has been strong in recent years. The company is well-positioned to continue to grow and profit from the increasing demand for cybersecurity solutions.

Market Share and Competition

CrowdStrike has emerged as a formidable player in the cybersecurity industry, capturing a significant market share. The company’s innovative approach to cloud-based security solutions has resonated with customers, propelling its growth.

The cybersecurity landscape is highly competitive, with numerous established and emerging vendors vying for market share. Key competitors include Palo Alto Networks, Microsoft, and Symantec. Each of these companies offers a range of security products and services, catering to different customer segments and needs.

Strategies for Gaining and Maintaining Market Share

CrowdStrike has employed several strategies to gain and maintain market share in the highly competitive cybersecurity industry. These include:

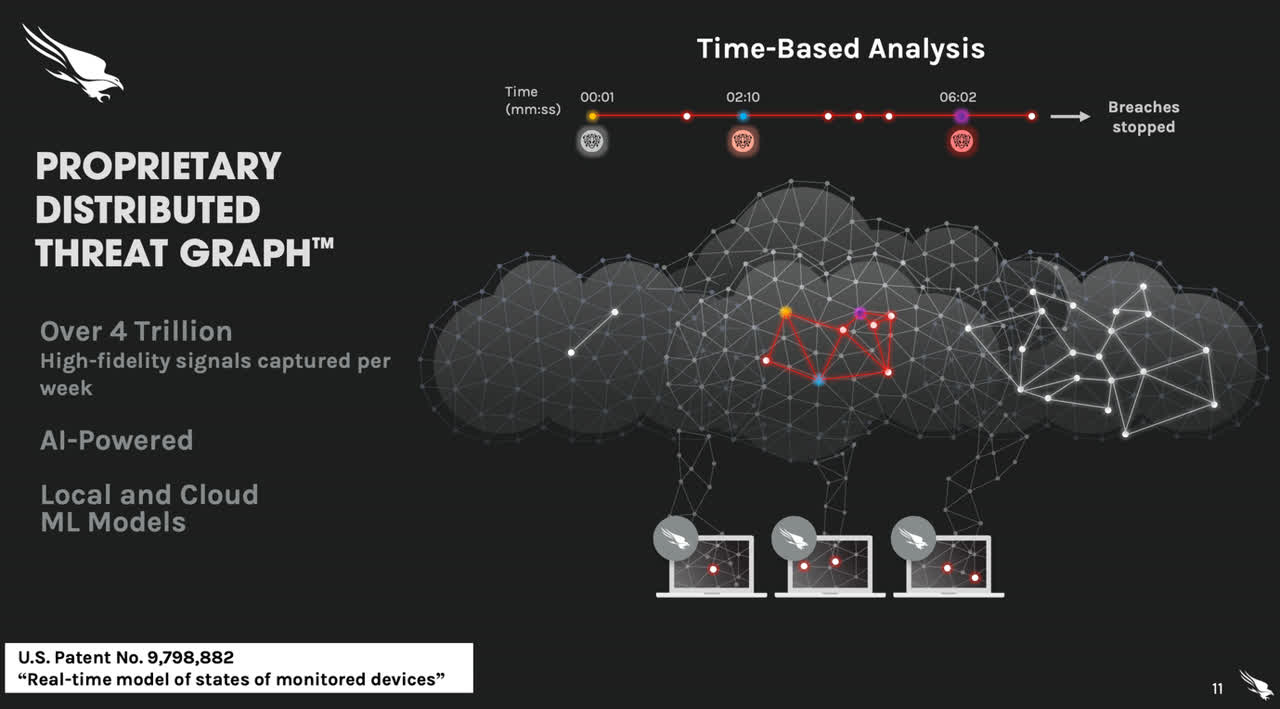

- Focus on Innovation: CrowdStrike has consistently invested in research and development, introducing cutting-edge security technologies that address evolving threats.

- Cloud-Native Approach: The company’s cloud-based platform provides scalability, flexibility, and cost-effectiveness, attracting customers seeking modern security solutions.

- Strong Partnerships: CrowdStrike has established strategic partnerships with leading technology companies, expanding its reach and enhancing its offerings.

- Customer-Centric Approach: The company places a strong emphasis on customer satisfaction, providing personalized support and tailored solutions to meet specific security needs.

Financial Health and Growth Prospects: Crowdstrike Stock

CrowdStrike has consistently demonstrated strong financial performance, driven by its subscription-based business model. In 2023, the company reported revenue of $2.34 billion, a 53% increase from the previous year. This growth was fueled by increasing demand for its cloud-based security solutions, particularly among enterprise customers.

Revenue and Profitability, Crowdstrike stock

CrowdStrike’s revenue growth has been accompanied by strong profitability. In 2023, the company reported a gross profit margin of 77%, an increase from 74% in the previous year. This increase was primarily due to the company’s focus on recurring revenue and its ability to leverage economies of scale.

Cash Flow

CrowdStrike’s strong financial performance is also reflected in its cash flow. In 2023, the company generated $924 million in operating cash flow, a 45% increase from the previous year. This strong cash flow provides CrowdStrike with the financial flexibility to invest in growth initiatives and return capital to shareholders.

Growth Prospects

CrowdStrike’s growth prospects remain strong. The company operates in a rapidly growing market for cloud-based security solutions. Additionally, CrowdStrike has a strong track record of innovation and has consistently expanded its product offerings to meet the evolving needs of its customers.

Overall, CrowdStrike’s financial health is strong, and its growth prospects are promising. The company is well-positioned to continue to benefit from the growing demand for cloud-based security solutions.